APPLIED DIGITAL BROKERAGE ANNUAL REPORT

2021 Digital Technology Adoption Survey: Key Insights

Brokerages leaned into their digital strategies.

1

Brokerages leaned into their digital strategies.

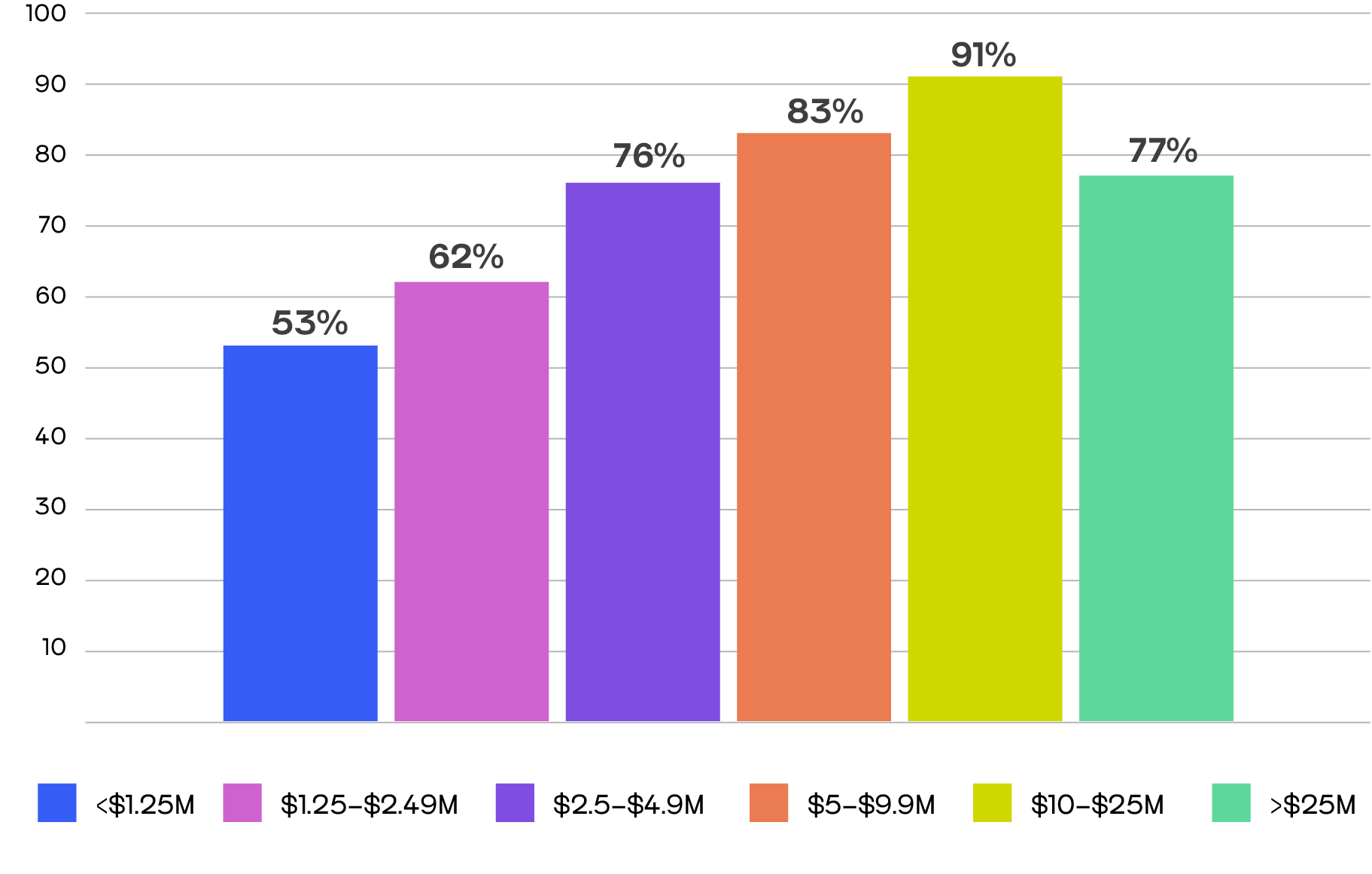

Having a digital strategy is becoming universal in the insurance industry. 66% of brokerages across all surveyed geographies have a digital strategy in place, a 7% increase year over year. Of the brokerages that report having digital strategies, the highest overall adoption rate is among Canadian brokerages (73%). Of these, 92% plan to implement their strategies within one to five years. Across all revenue buckets for Canadian brokerages, digital strategy adoption remains strong. In this year’s survey, the highest adoption rate for Canadian brokerages – 91% – was reported by mid-to-large brokerages grossing $10M to $25M.

Most Canadian brokerages have a digital strategy

Find Out More

2

Find Out More

Management systems have more to offer.

3

Find out more

Brokers aren’t using these types of tech enough.

4

Find out more

This empowers brokers and insurers to work better together.

5

Find out more

This tech has the highest adoption rate.

6

Find out more

This untapped resource could provide big insights.

7

Find out more

Customers want 24/7 access and brokers listened.

8

Find out more

This year’s digital technology adoption rate among independent brokerages is…

1

A digital strategy is essential for brokerages today. The lasting effects of the pandemic moved more business online and the insurance industry is no different. By focusing on how to use technology to create a competitive edge, brokerages can improve how they communicate with their customers and employees, work more efficiently, and most important of all, increase profits. Digital strategies allow brokers to reimagine how they do business through innovation.

A digital strategy is essential in a digital world

Do you have a digital strategy in place? (All Geographies)

Next-step tech

Next-step tech

A digital strategy is essential in a digital world

Do you have a digital strategy in place? (By Geography)

Do you have a digital strategy in place? (Percentage of Canada brokers responding "Yes" by revenue)

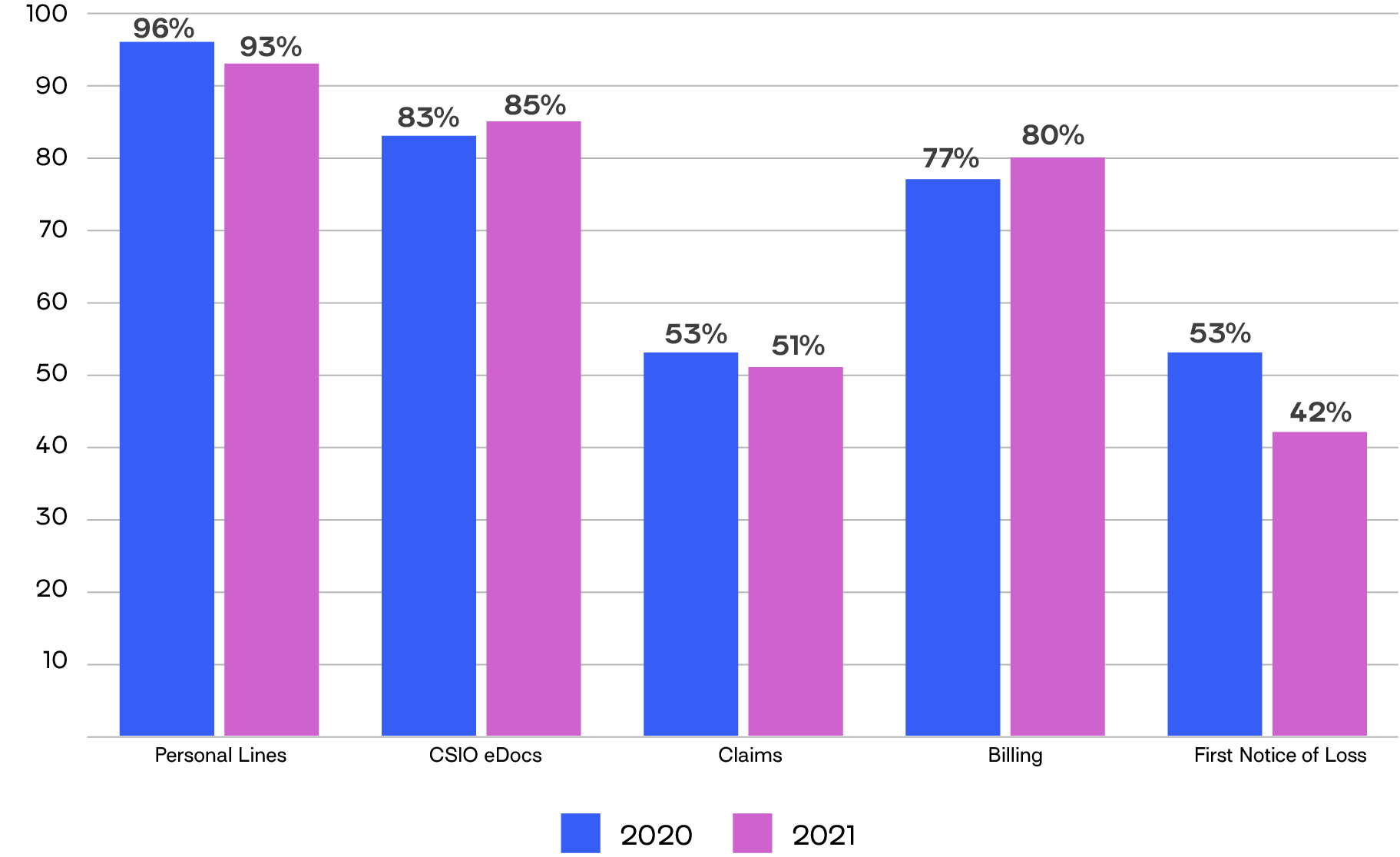

Which management system capabilities do you use? (Canada YoY)

Do you have a management system? (All Geographies YoY)

With nearly 100% adoption across all geographies surveyed, brokerage management systems are one of the most used pieces of technology in the insurance industry. Despite this high adoption rate and the robust functions management systems are capable of, not all management system capabilities are used to their full potential. Compared to the 92% of Canadian brokerages that use the system to manage documents and 90% for accounting and financial reporting, the survey found only 20% are using the integrated text features and 23% the integrated commercial lines submissions and renewals features within their management systems.

Management systems CAN do it all, but brokers don’t use it all

Management systems have more to offer.

The must-have tool for a successful brokerage

Management systems eliminate the complexities of using multiple, disparate systems. They combine the functions of multiple essential programs and applications to become a single, integrated system that is cost effective and highly efficient. They are an indispensable tool that help brokerages manage customer relationships, administer policies and benefits, automate sales, process accounting, and manage documents. Brokers who use this technology enjoy standardized workflows, seamless connection to their insurer partners and the easy discovery of new business opportunities from both current and prospective clients. Brokerage management systems are the foundation of any successful independent insurance brokerage.

The must-have tool for a successful brokerage

Next-step tech

Management systems are a single, integrated application that allow brokers to manage and maintain a clear picture of their entire brokerage across all roles, locations and lines of business. Easily accessible to any person in the brokerage, it keeps the front office sales team connected, automates back-office operations and integrates with customer service and insurer connectivity technologies. A foundational management system manages all aspects of the brokerage including leads, sales automation, policy management, insurer connectivity, data analytics, customer service technology, marketing automation, and more.

Next-step tech

2

What forms of download do you receive? (Canada YoY)

Integrated connectivity services remain a favourite among independent insurance brokers. Most Canadian brokerages use CSIO download for Personal Lines (93%), followed by CSIO eDocs (85%), Billing (80%), CSIO Messages (54%), Claims (51%), and lastly First Notice of Loss (42%). Use of download for Billing saw the greatest year over year growth with adoption increasing 4%.

A digital ecosystem better connects brokers to insurers

This empowers brokers and insurers to work better together.

Digital connectivity is a time-saver

By using technology that connects independent insurance brokerages to insurers, brokers can provide policyholders with the best advice, coverage and service. The rapid data exchange and the immediate access to accurate rates and policy details through insurer connectivity saves hours of time by providing all the information brokers need. Easier access to critical policy details gives brokers more time to focus on revenue generating activities and servicing clients.

Digital connectivity is a time-saver

Next-step tech

Connecting to insurer partners digitally empowers brokers to find the best rates, effortlessly submit business, and service their clients faster. Digital connectivity within the insurance ecosystem helps brokers provide high-value experiences for their customers. From quote to bind, insurer connectivity allows brokerages and insurers to interact seamlessly across the insurance lifecycle.

Next-step tech

4

Do you use a standalone CRM/sales automation application? (All Geographies)

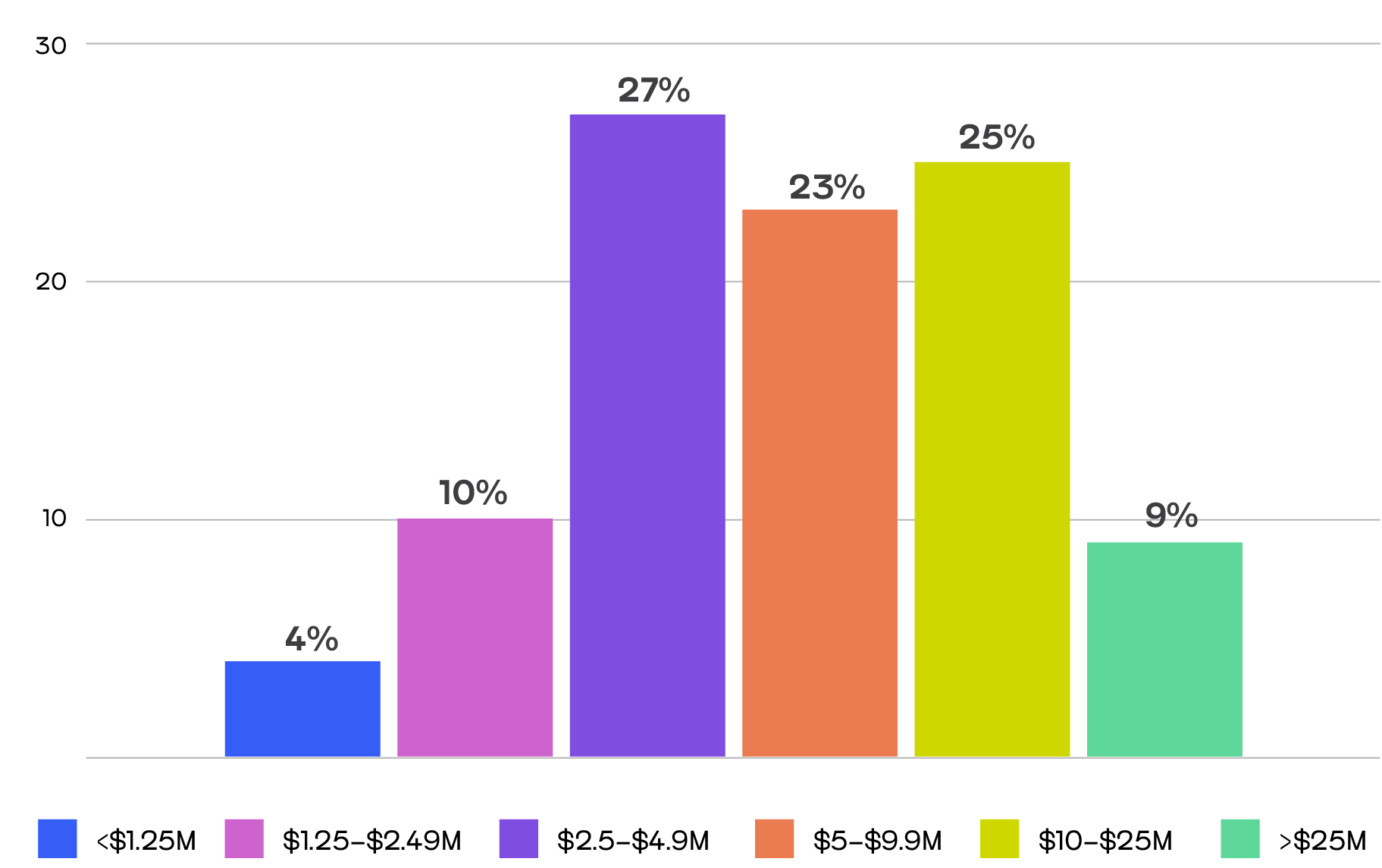

Of the geographies surveyed, 85% of brokerages do not use a stand-alone CRM/sales automation application. 72% of brokers are not using a stand-alone marketing automation application, however adoption is up 3% from 2020. Canadian brokerages with revenue of $2.5M – $4.99M are more likely to use sales automation (27%), while brokerages with a revenue of $5M – $9.9M are more likely to use marketing automation (64%). Canadian brokerages that gross less than $1.25M are the group least likely to use either technology.

The sales and marketing automation runway remains long

Brokers aren’t using these types of tech enough.

Only opportunity awaits

Automating sales and marketing can be an integral part of a new digital strategy. By automating these processes, a brokerage can quickly and easily stand out from their competition. And early adoption of these tools can make significant impact in the market. These capabilities are not reserved for large, high-revenue brokerages, they can be advantageous to brokerages of every size.

Only opportunity awaits

Next-step tech

Sales automation streamlines a brokerage’s sales pipeline and helps manage the complete customer lifecycle. Working in tandem with the management system, it provides a singular view of prospects and customers to both sales and servicing staff, making it easier to manage sales and drive higher renewal rates.

Next-step tech

3

Canada Brokerage Score by Employee Bucket

Canada Brokerage Score by Revenue Bucket

Overall Average Digital Score

44% is the average rate of digital technology adoption among independent insurance brokerages across all geographies surveyed in 2021. The U.S. scored the highest at 45%, followed by Canada at 43%. Ireland had the lowest score at 27%. When considering brokerage size by revenue, Canadian brokerages with revenue of $5M – $9.9M had the highest technology adoption score at 50%. When considering brokerage size by number of employees, the highest score was a three-way tie between brokerages with 10 – 24 employees, 25 – 49 employees and 50 – 70 employees at 49%.

Digital adoption remains steady

This year’s digital technology adoption rate among independent brokerages is…

Digital brokerages experience greater returns

Digital brokerages have the core capabilities needed to manage all sales and servicing workflows, online customer interactions and insurer connectivity, plus open architecture to support easy integration of point technologies to augment automation at each stage of the customer lifecycle.

The right tech stack gives brokerages the flexibility to integrate technology applications to increase automation and simplify workflows across all roles, deliver a digital customer experience, and create a competitive advantage. When technology eliminates mundane tasks, brokers are free to spend their time generating revenue, engaging prospects, and servicing clients to foster customer loyalty and increase renewals.

Digital brokerages experience greater returns

Next-step tech

Digital brokerage technology includes cloud based foundational management system, rating and leads, sales and marketing automation; self-service portals and mobile apps; and data analytics. The integrated technology connects brokers, insurers, current policyholders and prospects. Key benefits of digital brokerage technology include more efficient operations, more informed business decisions, better insurer relationships, improved customer service, and accelerated growth and profitability across all lines of business.

Next-step tech

8

Do you have a client self-service portal? (All Geographies)

Client self-service portals have seen steady adoption growth year over year across all geographies surveyed. The adoption of client portals increased from 35% to 38%, a 9% increase year over year. In Canada, brokerages with revenue of $5M – $9.9M are the most likely to use a client portal with a 48% adoption rate, followed by brokerages with revenue over $25M, which have a 43% adoption rate. Canadian brokerages grossing below $1.25M are the lowest adopters at 22%.

Self-service is on the rise

Customers want 24/7 access and brokers listened.

Customers want online access to their policies

A brokerage branded self-service portal or app gives policyholders the information and resources they need to manage their insurance policies without the help of a broker, anywhere, on any device, anytime of day. They provide an enhanced customer service by giving customers the freedom to initiate policy changes and quote new policies online; view, download and print policy documents; and pay their bills online.

Customers want online access to their policies

Next-step tech

Online customer self-service portals and mobile apps allow policyholders to manage their policies autonomously. When customers have the power to manage their own accounts brokers can spend less time with simple, yet time-consuming tasks like taking bill payments, making changes to policies, and sending policy documents. Instead, they can focus on generating revenue for the brokerage. Not only do brokerages that have client self-service experience more efficiency, but they also see an increase in customer satisfaction. An investment in client self-service technology and mobile apps quickly pays for itself.

Next-step tech

Currently only 32% of brokerages across all geographies surveyed are using data analytics to gain business insights from their management systems. While this adoption percentage is low, the adoption rate has grown more than 100% since 2016 and continues to trend upward. The highest adopters of data analytics in Canada are brokerages with revenue between $1.25M and $2.49M at 33%.

Data analytics adoption is slow but steady

This untapped resource could provide big insights.

The powerful potential of data

Knowledge is power and data is knowledge. By leveraging the data that brokerage management systems are already mining, brokerages of any size can benefit by gaining clear insights into the success of their business. Data helps to identify places where the brokerage can grow and where there is room for improvement, strengthening the entirety of the business. Thanks to developments in technology, it has never been easier to access and leverage data to make more educated business decisions.

The powerful potential of data

Next-step tech

Data analytics take the data from a brokerage’s management system and use it to give insights into key performance indicators for a brokerage’s book of business, employee operations and insurer relationships. Data storage is simpler using datalake architecture. It collects data from multiple sources to provide comprehensive analytical insights for brokerages with a few clicks. Once this data has been visualized into a dashboard, it can effectively help to identify sales opportunities with customers and prospects.

Next-step tech

6

Is your data hosted in the cloud? (Canada YoY)

Is your data hosted in the cloud? (All Geographies YoY)

Cloud technology is how 81% of brokerages across all geographies host their software in 2021. Year over year these numbers continue to climb in the surveyed geographies, with a 9% increase of adoption in the past year alone. Canadian brokerages with revenue of $1.25M – $2.49M (79%) and $2.5M – $4.99M (78%) are the most likely adopters. Canadian companies with revenue of more than $25M are the least likely to use cloud software but still maintain an adoption rate of 62%. Companies of this size continue to move to the cloud, and for good reasons. Hosting in the cloud is more secure than ever and makes working remotely easier for independent insurance brokers.

Cloud technology reigns supreme

This tech has the highest adoption rate.

The cloud benefits both the business and employees

The pace of business today and increasing customer demand for instant service means brokerages need to spend less time managing and updating their hardware and software. Businesses also need to ensure they are protected when the worst happens. Cloud hosting provides a flexible operating environment with scalability for business growth, stronger business continuity protection and increased mobile access to business information. By embracing cloud technology, brokers have peace of mind knowing software is updated, data is secure, and the business is running at its best.

Not only does hosting in the cloud boast greater security, but it also makes working remotely easier for brokers, an essential feature during a pandemic that kept brokers out of their offices. Cloud technology allows brokers to work from various devices and gives them more freedom to work from anywhere.

The cloud benefits both the business and employees

Next-step tech

Cloud computing is an application-based software infrastructure that stores almost unlimited data remotely, allowing it to be accessed anywhere, anytime. A cloud platform purpose-built for insurance business provides a flexible operating environment that scales for business growth, stronger business continuity protection and increased mobile access to business information.

Next-step tech

5

Enable [VISIBLE] overlay in each card pop-up and behind card carousel.

Do you use a standalone CRM/sales automation application? (Percentage of Canada brokers responding "Yes" by brokerage revenue)

Do you use a data analytics tool to gain business insights from your management system data? (All Geographies YoY)

Do you use a data analytics tool to gain business insights from your management system data? (All Geographies)

Do you have a client self-service portal? (Percentage of Canada brokers responding "Yes" by brokerage revenue)

About the Survey

1,819 independent brokerages across the U.S., Canada, UK and Ireland participated in the 6th Annual Applied Digital Brokerage Survey, from which the results of this report were generated. Respondents voluntarily participated in an online survey conducted in Q1 2021. The findings are based on responses to a set of questions about brokerage technology use. The responses provided the data to calculate a digital score for each brokerage taking the survey and identified baselines for technology adoption. The survey questions examined five core competencies of a digital brokerage, including management system capabilities, mobility, insurer connectivity, data analytics and cloud software. Brokerages scoring 80% or higher across all core competencies were considered to be digital brokerages, having adopted most of the key drivers of digital transformation.

Brokerage Revenue

Brokerage Size

Geographical Breakdown

United States:

Canada:

United Kingdom:

Republic of Ireland:

76%

17%

5%

2%

# of Employees

1-9:

10-24:

25-49:

50-74:

75-99:

100+:

48%

27%

12%

5%

2%

6%

< $1.25M:

$1.25 - $2.49M:

$2.5 - $4.9M:

$5 - $9.9M:

$10 - $25M:

> $25M:

43%

15%

13%

13%

10%

6%

Contact Us

Complete the form below to schedule a consultation.

Want to learn more about being a digital brokerage?

Thank you for your submission.

Someone will be in touch shortly to schedule a consultation.

About the Survey

A truly digital brokerage leverages innovative software to provide a better customer experience, increase employee retention and grow the book of business. By using a singular, integrated system, digital brokerages operate more efficiently, make better business decisions, form stronger insurer relationships, enhance customer service, and accelerate growth and profitability. The combination of a cloud based foundational management system, rating and leads, sales and marketing automation, self-service portals and mobile apps, and data analytics make it possible.

Digital Brokerage:

Foundational Management System:

Sales Automation Software:

Insurance Exchange:

Cloud Technology:

Data Analytics:

Digital Brokerage:

How far ahead is your digital strategy focused? (Canada)

44%

Cloud computing is an application-based software infrastructure that stores almost unlimited data remotely, allowing it to be accessed anywhere, anytime. A cloud platform purpose-built for insurance business provides a flexible operating environment that scales for business growth, stronger business continuity protection and increased mobile access to business information.

Mobile applications, or apps, are computer programs or software that can run on a mobile device like a phone or tablet. The increased accessibility it provides allows insurance agency staff to access and manage customer, prospect and overall business information when they are away from the office.

Cloud Technology:

Mobile App for Employees:

Can employees connect to the management system from a mobile device?

Digital Agency:

Foundational Management System:

Insurance Exchange:

Cloud Technology:

Data Analytics:

Customer self-service portals and apps:

Digital Agency:

44%

When integrated with the management system, marketing automation software helps brokers nurture customer and prospect relationships. It combines the power of targeted content with effective marketing email campaigns that can educate target audiences on the latest news and trends related to the insurance industry.

Marketing Automation Software:

Do you use a standalone marketing automation application? (Percentage of Canada brokers responding "Yes" by brokerage revenue)

Do you use a standalone marketing automation application? (All Geographies)

Digital Brokerage Score by Geography

Do you use a standalone marketing automation application? (Percentage of Canada brokers responding "Yes" by brokerage revenue)

Do you use a standalone marketing automation application? (All Geographies)

Is your software hosted in the cloud? (Percentage of Canada brokers responding "Yes" by brokerage revenue)

Digital Brokerage Score by Geography

Is your software hosted in the cloud? (Percentage of Canada brokers responding "Yes" by brokerage revenue)

Customer self-service portals and apps:

7